Why gold revaluation charts put prices at $25,000-$55,000 if history rhymes, silver poised for breakout: Crescat Capital Strategist

A rare convergence of gold demand from both Eastern and Western economies is fueling a significant rally in the precious metal, and silver is on the cusp of a major move back to its all-time highs, according to Tavi Costa, Partner & Macro Strategist at Crescat Capital.

Gold is never going back to $2,000: 'That's history,' prices to 3x from here – Peter Schiff

Gold prices are not dropping below $2,000 an ounce again in our lifetime following the metal's performance this year, said Peter Schiff, chief market strategist at Euro Pacific Asset Management.

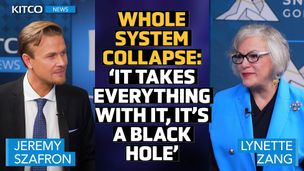

Is the U.S. in the heat of a recession right now? Jump in bankruptcies echoes global financial crisis – Danielle DiMartino Booth

The U.S. could be in the heat of a recession right now, according to Danielle DiMartino Booth, CEO and Chief Strategist for QI Research. A recent jump in bankruptcies in the U.S. resembles a similar pattern seen during the global financial crisis, DiMartino Booth told Kitco News' anchor Jeremy Szafron on the sidelines of the New Orleans Investment Conference.

Gold's U.S. market share to quadruple? What happens to gold price when that happens – Rick Rule

The only way for the U.S. to escape its current debt crisis is to inflate away the value of its obligations, much like what happened in the 1970s, said Rick Rule, veteran investor and President & CEO of Rule Investment Media. This dynamic creates a bullish case for commodities like precious metals, uranium, and copper, with energy also poised to benefit under the new presidential administration.