Nairobi – The International Monetary Fund should sell 4% of its gold to help offer debt relief to low income countries devastated by climate-related catastrophes, a study said as climate financing dominates early talks at the COP29 summit.

From the Caribbean to Africa, low income countries have turned to the IMF in recent years for support in the face of shocks like the COVID-19 pandemic, driving up repayments to the lender of last resort in subsequent years.

Although the IMF has a facility known as Catastrophe Containment Relief Trust (CCRT), this only covers 30 poor countries and has just $103 million available, said researchers from the Boston University Global Development Centre.

The CCRT is used to pay off an eligible member state’s loans to the IMF for up to two years, providing immediate relief and allowing those funds to be targeted at other priorities.

“Many climate-vulnerable countries have been unable to access the CCRT as its eligibility criteria fails to account for climate vulnerability … and funding is severely limited,” the researchers said in a report.

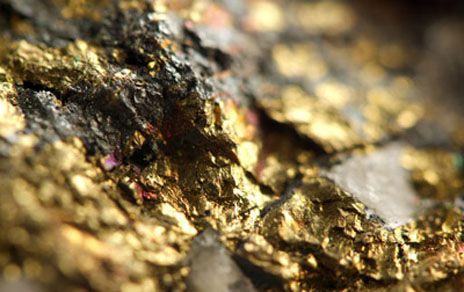

The solution lies in selling some of the IMF’s 90.5 million ounces of gold reserves, the report said, taking advantage of elevated prices to boost the fund and cover more countries.

Selling 4% of the IMF’s gold would generate $9.52 billion, the study said, covering debt relief for 86 countries.

“With current gold prices exceeding $2,600 per ounce, selling a small fraction of gold has the potential to generate significant revenues and easily replenish the CCRT,” it said.

Gold was trading at $2,606.42 per ounce on Wednesday.

IMF gold reserve sales are rare. The last was in 2009/10, when it offloaded an eighth of its reserves, which was triggered by the need to boost its lending capacity.

At its inception in 1944, member states used to pay their IMF quotas with gold, the research report said, meaning it accumulated reserves at a historical cost of just $45 per ounce.

Repayments of IMF loans are taking a bigger chunk of annual debt servicing costs for vulnerable economies, the report said.

The Indian Ocean island of Madagascar will pay $106 million to the IMF next year, a quarter of its debt service, rising to $158 million and 41% in 2026, the report added.

Mozambique will also experience an increase in repayments to the IMF during a similar period, the researchers found.

Any sale of IMF gold would require support from the bulk of its executive board members, and for member states to pledge to channel their share of the proceeds to the CCRT, they said.

“Replenishing the CCRT should be considered a high priority because, in contrast to other IMF lending programs, the CCRT comes with no conditionality,” they concluded.

(Reporting by Duncan Miriri; Editing by Alexander Smith)